Greece’s state-of-the-art electricity trading system is a disaster for consumers and a bonanza for fossil fuels suppliers

“Liquidity, efficiency and social welfare” was the promise behind Greece’s new hi-tech power trading market, which uses a unique algorithm to set prices for electricity.

Fourteen months after its introduction, that promise appears to have been broken. A system designed to regulate the market and protect consumers has exposed them to wild volatility, with Greek households and businesses tormented by the highest electricity price spikes in the EU.

In November 2021, Greece announced plans for its first climate law, pledging to stop burning coal as part of a move to a “net zero” economy. But rather than spurring the shift to renewable energy, the newly liberalised market has been a boon for producers of another fossil fuel—natural gas.

It is also hurting consumers. An investigation with SourceMaterial by The Manifold, a Greek investigative journalism group, found that the new system makes no provision to moderate extreme swings in the price of gas, which now accounts for 40 per cent of the country’s energy mix.

(The full investigation, published in partnership with Reporters United, is online in Greek here .)

The new energy exchange was intended to bring Greece in line with other countries in the EU. But liberalisation in Greece has been extreme: France trades 29 per cent of its energy supply through an exchange, Italy 11 per cent and Poland just 1 per cent.

Greece, meanwhile, trades 100 per cent of its electricity supply through the market—the only European country to do so.

That is because while other regulations in other European countries contain incentives for longer-term supply contracts that stabilise prices, the Greek “target model” allows companies to pass the higher costs of trading electricity on the daily spot market to consumers.

The result is that Greece has stripped itself of safeguards against market volatility and soaring prices, says Pantelis Kapros, a professor at the National Technical University of Athens and former chair of Greece’s energy regulator.

“The target model was designed as a market for modifications”, said Kapros. “Not as a market that, though it isn’t supposed to be mandatory, ends up being so because 100 per cent of Greece’s energy goes through it”.

As Greece moves away from burning lignite, a particularly polluting form of brown coal, the new mechanism is skewed in favour of bigger producers—invariably suppliers of gas rather than renewable energy: market data shows that prices have risen in parallel with increases in gas supply.

And because gas companies play an important balancing role, especially when low winds or heavy cloud reduce renewable energy output, they have been able to influence prices in their favour.

The Manifold’s investigation found that this ‘balancing electricity’ has on multiple occasions been sold at 3000 euros per megawatt hour, compared with its production cost of between 50 and 100 euros. At one point last November, Greece was paying 14 times the EU average in balancing costs.

The situation became so dire that the environment and energy minister, Kostis Hatzidakis, held talks with the four major companies that own natural gas plants (DEI, Elpedison, Protergia and Heron), in an effort to convince them to stop inflating the market.

But while prices receded temporarily, they have remained on average significantly higher than before the introduction of the trading system. Greece’s energy regulator, RAE, says that price caps advocated by some observers would be against rules set by Brussels.

When in mid-2021 rocketing gas prices and reduced gas supply from the US, Norway and Russia sparked a European energy crisis, Greece’s new system left it unprotected. Households saw bills increase by as much as 96 per cent, while for businesses faced a rise of up to 720 per cent.

Lack of transparency means consumers have been kept in the dark about how energy companies have rolled increased costs onto them without shouldering any of the risk, says Panagiota Kalapotharakou, the head of EKPOIZO, a consumer rights group.

In an attempt to correct the situation, the regulator has proposed introducing new prototype contracts and bills that would allow consumers to be aware of the risk involved.

All of the suppliers have so far opposed the reform, which would need approval from the Ministry of Energy. No such action has been taken so far.

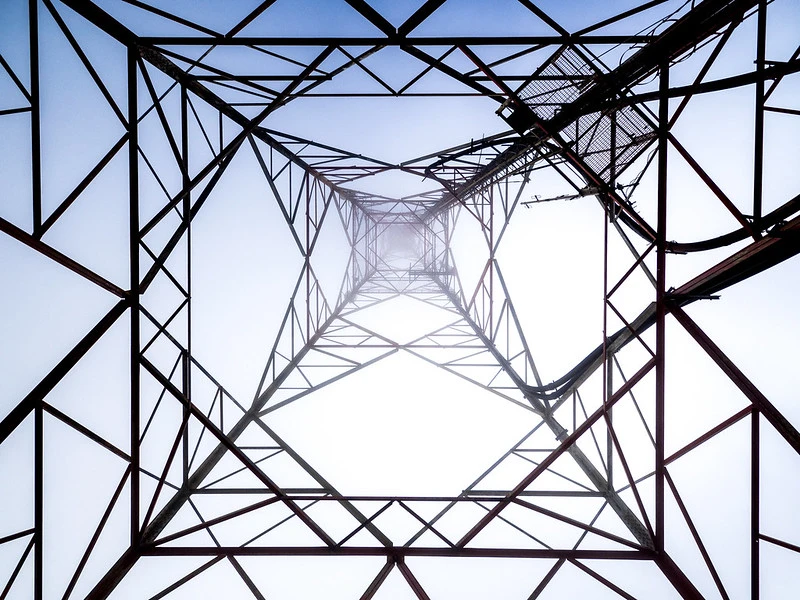

Picture: Pylon on Mount Pantokrator, Corfu by William Warby licensed under Creative Commons